Contributing taxes is a fundamental way for investors to foster a country’s development and support its planned initiatives. In Rwanda, individuals wishing to fulfill their tax obligations must obtain a Taxpayer Identification Number (TIN) from the Rwanda Development Board (RDB).

A TIN Number is a unique identifier used by taxpayers during tax declarations and payments. Sometimes, individuals misplace this crucial information, leading to anxiety. However, there is no need for concern anymore. Discover how to simplify the process of retrieving your TIN Number in the following guide.

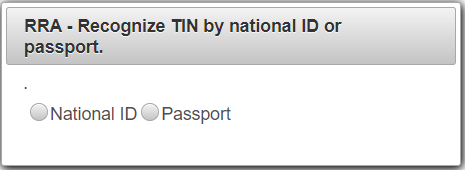

Step 1: Begin the process by accessing the Rwanda Revenue Authority’s website via the provided link: https://etax.rra.gov.rw/nidAssignedTIN/. This official platform assists individuals in retrieving their TIN Number by utilizing their ID or Passport information.

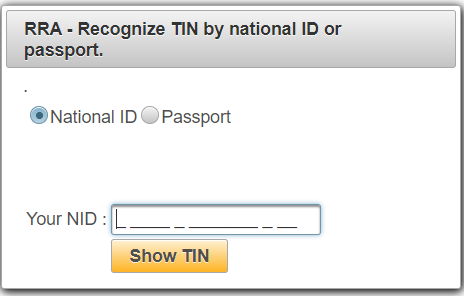

Step 2: For Rwandan citizens, select the National ID button. If you are not a Rwandan citizen, select Passport. Enter your National ID number or Passport information in the designated field. Once completed, click on the “SHOW TIN” button to proceed.

By following the steps outlined in this guide, you can easily retrieve your TIN through the Rwanda Revenue Authority’s user-friendly website. Complying with tax regulations not only supports the country’s growth but also ensures your seamless participation in the nation’s progress. Embrace this straightforward process to stay tax-compliant and contribute to the collective advancement of Rwanda.

Thank you for reading, if you liked this post, it is possible that you will love other posts from us, join our community on WhatsApp if you want to learn more about what we do, visit our corporate website or use our email [email protected] to reach out to us.